HOW THIS GLOBAL BANK USED AI/ML SOLUTIONS TO DETECT CHECK FRAUD

- 13/12/21

- GRAPES

OVERVIEW:

Cash is the king, especially for banking and financial institutions. The banking sector needs to have a proper record of cash inflow and outflow and keep itself out of every fraud activity. However, millions of cheques are still handwritten in banks each month. Handwritten checks, unlike electronic payments or automated clearinghouse (ACH) transactions, must be confirmed one by one by individuals. Banks lose millions of dollars each year to counterfeiters.

That’s when a Global bank decided to approach the popular company cognizant to develop a technology solution to reduce the incident of check fraud. The company decided to make use of Artificial intelligence and designed an AI-powered machine learning system to detect possible fraud by analysing scanned images of handwritten checks. The solution teaches itself to identify counterfeit checks by comparing them to a growing database of previously processed ones.

APPROACH:

A blend of Artificial intelligence and Machine learning

ACH transactions helped to reduce check processing time significantly in recent years. While some of this process is automated, such as scanning paper checks, huge banks still employ hundreds of humans to sit at computer screens every day, looking for signs of fraud in those scans. The client bank used optical character recognition (OCR) and deep learning technology to scan checks, process data and verify signatures. But the processing of handwritten checks remained difficult to process. The ultimate objectives of the cognizant team were to spot fraudulent checks in real-time at the time of deposit and to reduce the number of checks requiring manual review.

The cognizant model, based on Google TensorFlow, uses a neural network to parse a history database of previously scanned checks, including those suspected of being fraudulent. This enabled them to rely on massive data sets of check variable elements such as payee, check number, account and routing numbers, amounts, endorsements, and even the signature. Then created a set of comparing algorithms to determine what is considered the norm for excellent checks and what is not.

These rules were used to train the neural network, and it is now teaching itself. The solution analyses signatures and images automatically, eliminating the requirement for secondary reference images. It examines photos to ensure that all relevant information is present. It detects irregularities and provides a confidence score almost instantly, indicating whether a check is valid, clearly fraudulent, or requires additional investigation. This influences whether and how much money is made available to depositors.

RESULT:

A Win for the global bank

The model demonstrated a 50% reduction in fraudulent transactions with a Processing speed of 20 million checks a day, with end-to-end response times of less than 70 milliseconds and processing up to 1,200 checks per second.The model significantly reduces the operational costs of manual check processing and it becomes more accurate as it processes more checks.

Recent Post

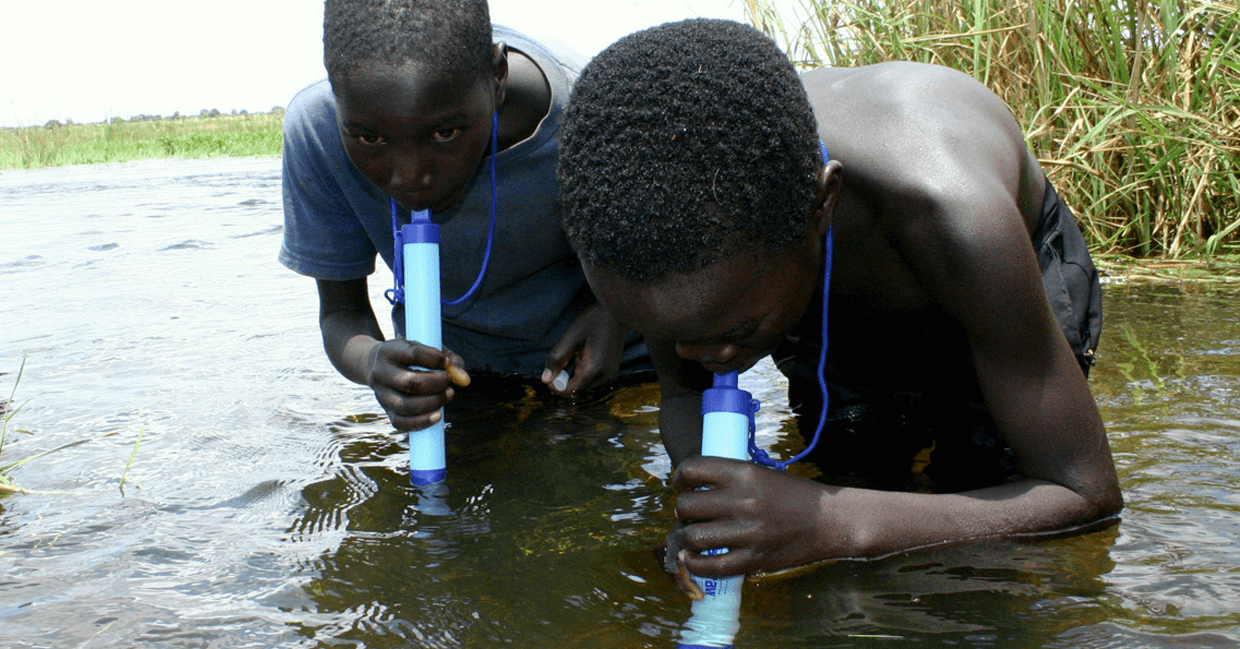

HOW TECHNOLOGY HELPED GHANA TO GET CLEAN WATER

- 24/11/22

- GRAPES

HOW THEY ARE TRYING TO BUILD THE HAPPIEST CITY ON THE EARTH

- 11/03/22

- GRAPES

HOW THIS GLOBAL BANK USED AI/ML SOLUTIONS TO DETECT CHECK FRAUD

- 13/12/21

- GRAPES

HOW NINJAKART IS IMPLEMENTING TECHNOLOGY TO BENEFIT FARMERS

- 13/12/21

- GRAPES

Copyright © 2021-2024 GRAPES (Global Resource for Automation Projects & Enterprise Services) Privacy Policy | Terms & Conditions | Disclaimer

_1_11zon.jpg)

_2_11zon.jpg)